Flexible Benefits as a Strategic Lever for M&A

Martin Shen and Angela Zhou

With mergers and acquisitions becoming more prevalent, especially in emerging markets, post-merger integration has also become an increasingly critical issue that concerns acquirers and acquirees alike. Retention of people is considered one of the determining factors of the success of an M&A deal. Harmonization of total rewards (compensation, benefits, learning and development opportunities, etc.), is often conducted with the objective of achieving positive synergy, while minimizing negative impact on talent retention or escalating costs. Employee benefits, among other total reward components, is usually viewed as one of the biggest challenges to tackle during harmonization. “Flexible benefits” (Flex) has proven to be an effective tool for companies facing this difficulty.

The Challenges of Benefits Harmonization

Benefits harmonization is undoubtedly one of the most challenging tasks post M&A. The newly formed company is often faced with a larger workforce and a new and more diversified employee demographic. The employees of both entities are keen to know the implications of the changes to their existing benefits program. They want to understand how the new plan will affect their coverage level, whether any benefits will be removed or terminated. It is quite likely that employees view their existing benefits as “entitlements.” The greater the existing benefits offerings, the more challenging it is to make changes to the program.

A benefits plan’s cost is not always reflective of its value, which is what truly matters to employees. In many cases, positive correlation cannot be found between the benefits value and cost. Take group insurance and medical cover as an example. They are the most common benefits plans offered by companies. For the same plan provided by the same insurance company, the cost can vary a lot depending on the covered workforce, sex ratio, age, and claim history. If the same plan costs less for Company A than Company B, can we then conclude that it brings less value to employees in the former? You would agree, the answer is – not necessarily.

The math behind benefits harmonization is tricky. An example of this is wealth accumulation plans – the employer contribution is obviously one of the most eye-catching elements, but the vesting schedule and withdrawal conditions also have a noticeable impact on the employee’s perceived value. For instance, Company A provides a supplementary retirement plan that contributes 10% of monthly base pay for employees. Company B, which has been acquired by Company A, provides a similar plan with the same employer contribution. Company A sets a 10-year vesting schedule, which means the employees need to serve at least 10 years to get 100% of the contributed amount; whereas in Company B, the waiting period for 100% is only five years.

The problem here is this: if maintaining two sets of different retirement plans is not an option, how do we integrate them without impacting either employee benefits or company cash flow? If an impact is unavoidable, how can we minimize it? In fact, besides the vesting schedule itself, other factors like employee participation time, withdrawal conditions, and other relevant rules only add to the difficulty of harmonization. Even this is not a worst-case scenario – at least both of the plans are DC (Defined Contribution) plans. Imagine what it would be like if Company B had a DB (Defined Benefit) plan instead – the complexity of harmonization would rise to an entirely different level.

Another major challenge is integration of benefits vendors. It seems obvious that harmonization usually leads to better service and better prices from vendors because of the stronger bargaining power brought by the bigger size of the workforce covered. However, price is not the only deciding factor in vendor selection – geographic coverage, historic data, service level, and transition solutions all need to be taken into consideration. Very few companies would opt for no harmonization at all, and this brings us back to the question of how to maximize the return on investment if harmonization is bound to happen.

All in all, the golden rule here is finding the balance point between budget and perceived value to employees. A simple way of closing the benefits gap between two parties is through additional spending to bring the lower one up to the level of the higher one. This solution is more likely to work when the gap is small, and the cost increase is containable. When the gap is big, either in the total budget or in the design of individual benefits plans, this solution will probably turn into a cost black hole that no executive or shareholder would accept.

Flex – The Answer to the Quest

For HR departments beleaguered by the dilemma of budget control and talent retention in merging organizations, Flex has proved to be the answer to their quest. How does Flex help to strike a balance between benefit value and benefit budget? Firstly, let us look at it from the employer’s perspective and see how Flex works to control long-term cost, taking an example of a medical benefit plan. The following describes a real situation in a company:

In year 2011, the company’s average benefit budget was $5,000. The benefit scheme included provision of 80% outpatient & 90% inpatient cover, capped at CNY 20,000 per year. In year 2012, because of obvious abuse of the medical plan, the insurer decided to increase its price by 20%, which brought the average benefit cost up to $6,000. The company had no choice but to accept the cost increase, as it was unlikely to get a better price from another insurance company due to their poor claim history. Furthermore, adjustment of the plan would impact the company’s benefit competitiveness and threaten employee retention, which is precisely what the management dreaded.

If the company had used Flex, the story would have been different. Let us suppose that what the company provided to its employees were $5,000 benefit credits, instead of a benefit scheme costing $5,000. With these credits, employees could choose from a range of different benefit options.

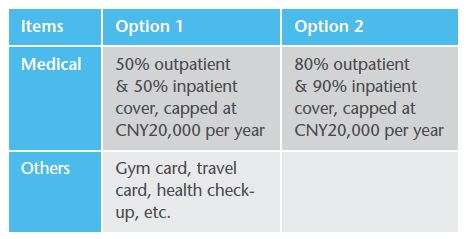

Behavioral studies of employees tell us that the healthy ones tend to choose lower medical insurance cover (option 1), and use the remaining credits in other work-life benefits like gym cards, travel cards, etc. (see table below):

In this scenario, when the insurer requested the 20% cost increase, the company would have been in a better position to bargain with it. The healthy employees who chose option 1 should not be held responsible for the poor claim ratio, which was more likely caused by employees who took advantage of the better medical cover in option 2. The more reasonable solution was to keep the price of option 1 unchanged, and increase only the price of option 2. The company could now decide whether to make no change or to increase the credit entitlement to cover the additional cost incurred. No matter what the company decided, it had better control over the budget due to a graded impact in medical inflation.

At the same time, the employees are empowered to make a choice and select the benefits that matter most to them. This leads to better awareness of benefit entitlements and derivation of higher value to employees through better utilization of benefit plans. Aon Hewitt helped a leading insurance company adopt a flexible benefits program to harmonize benefit platforms. Upon successful implementation of the plan, the impact could be seen through an overwhelmingly positive feedback by employees, higher engagement scores, and a remarkable improvement in the engagement survey participation rate (totaled 99.7%).

Besides its advantages for long-term cost control, Flex also has shown its value in cost saving and employee retention immediately after a merger. It makes cost-neutrality possible for benefits harmonization and concurrently minimizes negative perception of the change. This is because it aims to harmonize the benefits scheme, instead of the budget. The benefits budget that the employee has from the employer remains consistent, yet it creates greater awareness and appreciation.

Conclusion

Flex has manifested its great potential as an effective way for employers to retain talent and control cost. Admittedly Flex is not the only approach for benefit harmonization post M&A, but it is a strategy that has been tested in different markets and has been well received by employees undergoing significant organizational change. Explore how Flex can help you when you face the challenge of talent retention in merging organizations.

Authors

Martin Shen, Director, Head of Benefits Consulting of North China ([email protected])

Angela Zhou, Senior Benefits Consultant of North China ([email protected])

Get in touch