Risk Aspects to Consider While Doing Deals in Asia Pacific

By Justin McCarthy

While buyers have long considered their financial, legal and commercial risks in the course of M&A transactions, there is increasing awareness in Asia of how insurance can be used to transfer “transaction liability” risks from either the buyer or the seller to the insurance market. In addition, the importance of understanding, prior to signing, how ongoing operational risks can be mitigated by insurance has led to the increased use of insurance due diligence.

Transaction Liability Risks

The most prominent transaction liability risk transfer tool is Warranty & Indemnity (W&I) Insurance (sometimes referred to as Reps & Warranties Insurance), which has been in use in Europe and North America since the late 1990s. In the last five years, it has become a staple of the majority of deals in Australasia where private equity is involved and is increasingly being considered on private equity and strategic deals in Asia.

W&I Insurance covers breaches of seller warranties under a Sale & Purchase Agreement (SPA). A seller can use it to backstop or replace their obligations to indemnify a buyer for a warranty breach; a buyer may use it to supplement, back-up or even replace a seller’s obligations. As the breadth of warranties and the related indemnification regime can be major points of deliberation during the negotiation of an SPA, this product is increasingly being used by parties to a transaction to reduce or completely transfer their risk.

While the strategic uses of this product have been understood for some time in Western markets, there is a growing recognition in Asia that insurance capital can help get deals done by offering downside protection to either side in a transaction.

This awareness has been facilitated by a recognition of the strategic uses of the cover which include:

-

A seller wanting to have a clean exit and no trailing risk of having to meet a warranty claim;

-

Replacement of escrow accounts and distribution of sale proceeds/reinvestment of capital;

-

A buyer having collection concerns in the event of a breach-distressed sellers, group of disparate sellers;

-

Passive sellers being asked to give warranties where they have not been involved in the day-to-day running of the business

- A buyer entering a new market, wanting to have greater downside protection.

As a result of this increased understanding of how insurance can be used to transfer deal risks, policies have been placed for transactions in Japan, Korea, Greater China, Malaysia, Vietnam and Indonesia as well as Hong Kong and Singapore. Insurers have appetite to underwrite these risks in most countries in Asia, bar those that are subject to sanctions by the United States.

Other examples of “transaction liability” risks where insurance capital can be used to reduce risk include litigation cap insurance (where the potential risk of litigation against a target company can be capped with insurance), successor liability insurance (on asset deals where the newco may be found to be the party that should indemnify third parties for injury/damage arising from historic events) and tax liability insurance.

Ongoing Operational Risks For Target Companies

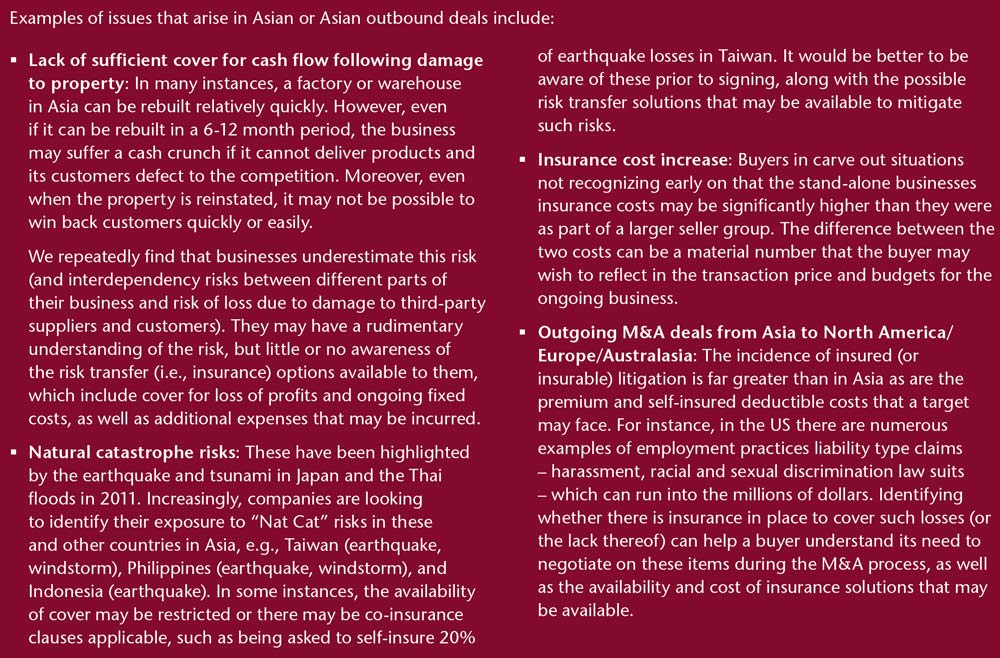

In the past, checking on the insurance for a target has often been seen as something that can be dealt with as a “tick box” item in the course of due diligence (dd), with the legal advisers being asked to provide a summary of the coverage purchased for a target company. However, having the knowledge that there is cover in place is barely useful, if there is no understanding of whether that cover is appropriate and adequate for the risk profile of the business being purchased. It is quite possible that the target may have inadequate cover, or cover that leaves it self-insured. Law firms are not in the business of identifying insurable risks or advising on how these risks are best transferred to the insurance market.

In effect, many purchasers “don’t know what they don’t know” when it comes to this area of risk, so a proper insurance due diligence exercise can supplement any initial work undertaken by the legal dd advisers.

The above are just a few of the examples of where insurance and insurance consulting services can assist buyers (and sellers) in completing deals. More information on these and other M&A services can be found at www.aonamas.com.

Author

Justin McCarthy, Regional Director, Aon M&A Solutions ([email protected])

Get in touch