Soaring Profits: The Successful Merger of Two Retail Giants

A first-hand account of how Aon’s recommendations helped two retail giants in Southeast Asia streamline their processes, achieve higher efficiency, optimize and add bottom-line during a merger.

Introduction

2013 was a tumultuous year for mergers & acquisitions. While some large corporations have indulged in billion-dollar transactions viz. Microsoft’s acquisition of Nokia, PriceWaterHouse’s buyout of Booz and Heinz’s takeover by Berkshire Hathaway; overall, the M&A environment globally and in Asia had remained gloomy all of 2013. M&A activity had been at its lowest in the last 3 years as organizations continue to struggle with both organic and inorganic growth in an otherwise sluggish business world.

However, the first half of 2014 has turned out to be much more action oriented, with large deals being witnessed both globally and in the Asia Pacific Region.

Aon Strategic Advisors & Transaction Solutions (ASAT) continues to support its clients through various transaction stages, both in the areas of risk advisory and human capital management. It has had the privilege of working on some of the most marquee transactions and handling all of them with great success. Aon’s recommendations have helped these corporations achieve their deal targets with minimal business disruption.

Client situation/Background

One such request that came to Aon in early 2013 was from two Southeast Asian retail giants, that had hypermarket chains across the Asia-Pacific region. In this case, a Southeast Asian retail chain was taking over the operations of a European hypermarket business in a large Asian country. The acquiring organization had existing operations in this Southeast Asian country and therefore, the deal goal was to enhance market share and revenues. The new entity also intends to launch an IPO in 2015 and list itself in the leading stock exchanges across the region.

Client challenges/Issues

The two organizations had many similarities and even more differences. On the business front, they catered to two different customer segments – the acquiring company focused on middle income group and below, and acquired company focused on middle, upper middle and higher income groups.

This meant that the products for their customers were also different and a complete merger was challenging and difficult. They also had significant different organization structures, manpower ratios and distribution of responsibilities within functions. However, the most striking difference of all was their organizational cultures.

Legacy culture at the acquired organization had the following characteristics:

Aon has learnt that ‘organizational culture’ is the single-most important factor when it comes to deal success. As per the research on acquisitive organizations in Asia 2012-13 ‘Making M&As Successful Study 2012-13’ reveals the following key findings:

- Culture operates at multiple levels - National culture, operating culture and individual cultural biases

- Culture gaps across the two entities can be a significant challenge for leadership teams. In some cases, business results may be delayed/denied. A root cause analysis will generally reveal a lack of productivity or a lackadaisical culture in one of the entities.

- Culture alignment should be a key priority: Constant focus on cultural alignment is required during due diligence, pre-announcement, and integration

Hence, it was extremely important for Aon to ensure cultural alignment during the post-merger integration stage, while undertaking this assignment.

Simply put, the brief given to Aon was – Ensure maximum alignment between the two organizations with minimal business disruption and employee attrition, also identifying opportunities for cost-saving and creating bottom-line impact through synergy of structures, systems and processes.

Aon’s approach

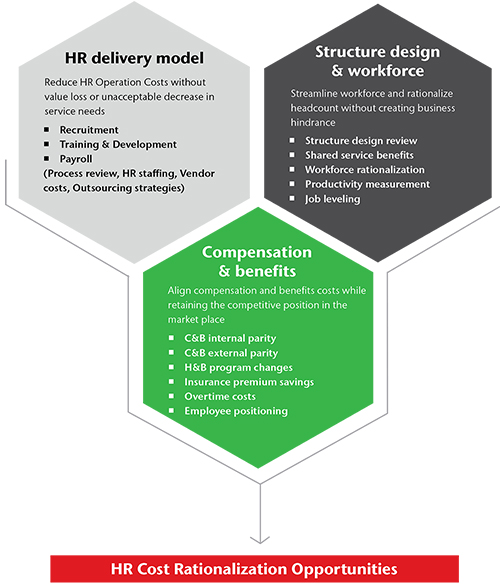

To achieve the aforesaid, Aon employed its well-researched model on Strategies for Operational Excellence.

Aon commenced by conducting detailed interviews with leadership teams of both the organizations in a bid to understand the organizational background and context, strategies, value chain, organization structure, and possibility of functional alignment. A key focus area during these interviews was to understand the similarities and differences that exist in their systems and processes, and more importantly, identifying the cultural nuances and differences.

Aon also conducted a thorough review of data and documents that were received from the client. These documents requested by Aon pertained to organization structure, job descriptions, grade structure, HR policies, HR operations metrics and data (recruitment and selection, learning and development, performance management), manpower numbers, employee compensation and benefits, attrition, etc.

Aon conducted numerous one-on-one interactions with employees across levels, functions and regions, and Focus Group Discussions (FGDs) both with employees in hypermarket stores as well as in the corporate office. The objective of these discussions was to capture the employee pulse, expectations from the new organizations, areas of strength and opportunity for the organization, etc.

We also conducted an in-depth benchmarking exercise for all systems and processes with our existing proprietary databases in the Retail Sector and with Best Employers.

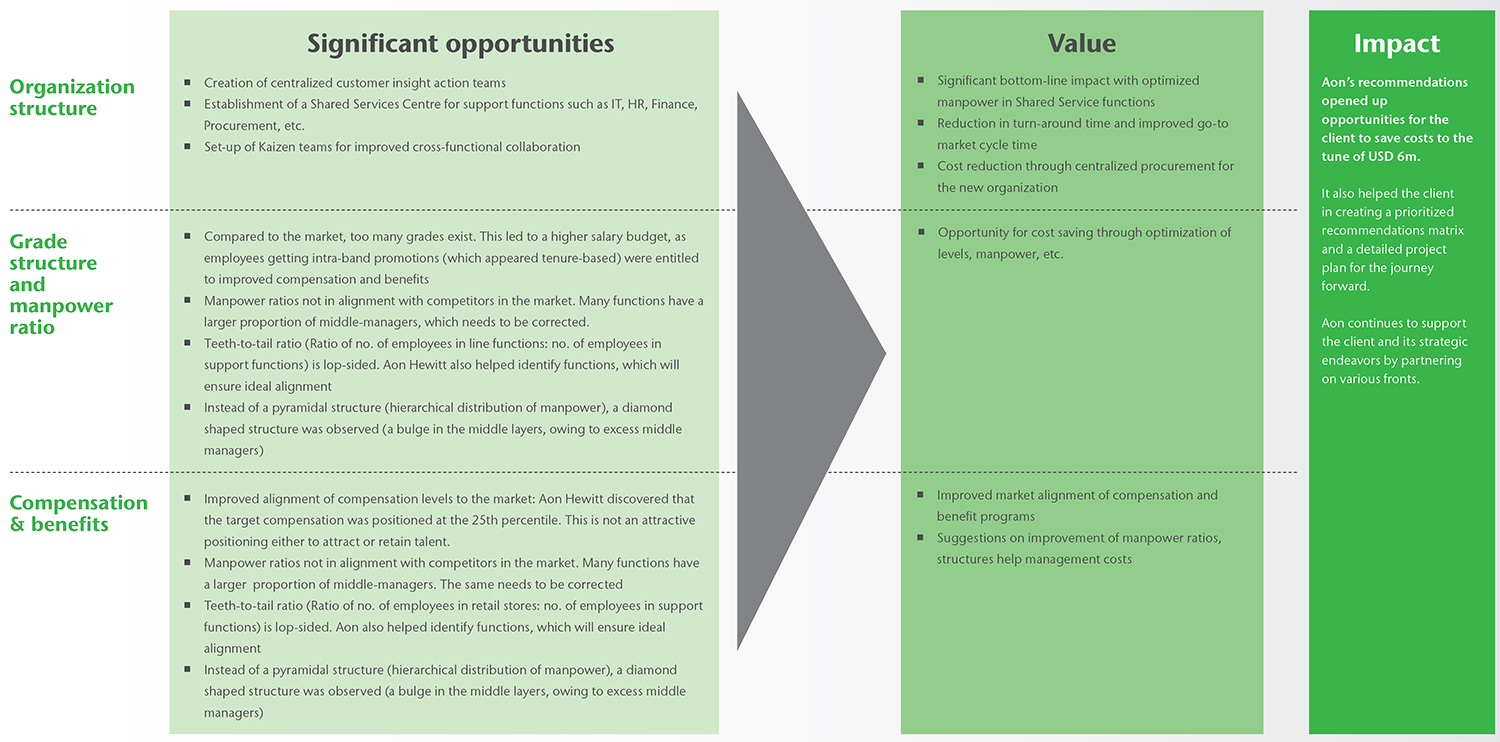

Value and impact created as a result of Aon approach

Author

Nisheeth Jankar

Aon Strategic Advisors & Transaction Solutions

nisheeth.jankar@aonhewitt.com

Follow us on LinkedIn & Twitter

Get in touch