As organizations focus on growth in 2012 and beyond, many are realizing that acquisitions and joint ventures are required to meet their growth objectives. The ability to be successful in acquisitions and joint ventures depends on the quality of the due diligence, particularly due diligence in human capital, which is core to the success of most transactions.

The Changing Nature of Due Diligence

Over the years, the nature of due diligence has changed. Years ago, it was common for all members of the due diligence team to gather together in a room and review the relevant documents. If you found something of interest, you could walk across the room to your colleagues and share your findings. If there were questions, you could walk down the hall and have your questions answered through direct conversations.

With the advent of electronic data rooms and a desire to minimize costs, due diligence has become more of a virtual exercise with diligence team members accessing documents directly from their desks. The diligence team members may not even meet each other in person and the chances of effectively sharing their findings across the team have become increasingly challenging.

As the global complexity and size of deals increase, so are the attendant risks. Also increasing is the importance of due diligence – particularly human capital due diligence. An increasing number of transactions are focused on growth and with that, there is an increasing need to focus on the talent within acquired organizations. As you consider the core elements of growth (e.g., new or improved technologies, increased sales), it is easy to understand the important role of talent in realizing synergies (e.g., research & development, sales personnel, management).

The Critical Role of Human Capital in Due Diligence

Many organizations are fond of saying that people are their most important asset. Assuming this is true, it is important to understand the critical role of human capital in due diligence.

Initially, due diligence is about understanding the impact of people on the transaction. In part, the people impact can be understood in financial terms (e.g., annual payroll, outstanding retirement obligations, pending employment claims). Financial terms, however, are only a part of the impact of human capital. Perhaps the more significant impact of human capital is the difference people make in the value of the company. What are the track record and prospects for the research & development team? What is the nature and quality of the customer relationships with the sales team? What is the experience and perception of the management team? All of these questions require human capital due diligence far beyond financial statements.

Due diligence is also an opportunity to assess the impact of the proposed transaction on people. Will the transaction result in operational changes that will affect people in the target organization? These impacts could either be operational synergies (requiring staffing and selection decisions or potentially workforce reductions) or new growth opportunities requiring additional staffing. Impacts on people might also appear as changes in objectives or strategies that require people to work in different ways than they have in the past.

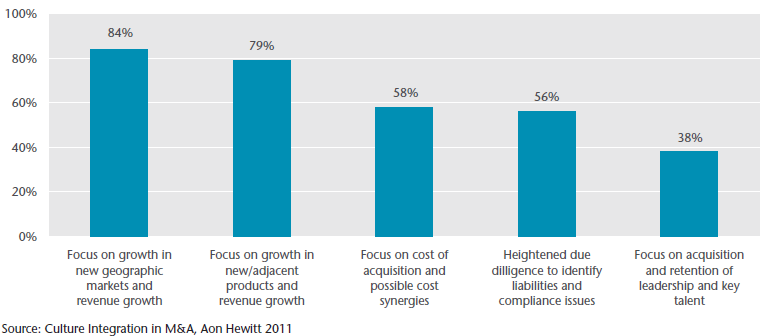

Top Two Areas of Focus in M&A Activity Over the Next Two Years (% of respondents)

In short, due diligence is not only understanding how the company has operated historically, but how it might operate following an acquisition. In that sense, due diligence truly is the beginning of integration planning. A strong understanding of the potential impacts of integration is essential to an accurate financial model (i.e., paying the correct purchase price) and a complete due diligence.

Improving Your Capabilities in Human Capital Due Diligence

With the changing nature of due diligence and the critical role of human capital in due diligence, there is a greater interest than ever in improving capabilities in human capital due diligence. Improved capabilities in human capital due diligence can be developed in a number of different ways.

Organizations that recognize acquisitions as a core part of their growth strategy are also looking more carefully at how they develop internal HR team members. A number of organizations that focus on acquisitions include acquisition interest or experience as a key element of their talent identification and development processes. As you consider the skills required to be effective in a due diligence setting, it is often a blend of technical expertise, a sound understanding of the acquiring organization (to identify potential integration concerns) and an appropriate level of judgment and tact – these individuals are, of course, potential representatives of your organization in a potential acquisition.

One approach to building capabilities in human capital due diligence is the development of a sound set of supporting due diligence materials. These materials include items such as comprehensive data requests, reporting templates, detailed cost models, cultural assessment tools, and interview guides. These materials help to ensure a consistent approach to due diligence while providing resources for less experienced members of the due diligence team.

In considering the development of a supporting set of tools, a number of organizations have also looked to the development of M&A Playbooks or even a web-based transaction management system (e.g., Aon Hewitt’s TransAction Manager) as a means to gather the available resources and provide a sound framework for executing transactions. These materials typically provide a broad range of resources – organized either by subject matter or process phase – to help support the due diligence process.

It is often said that there is no substitute for experience. If this is true, how do organizations with a limited history of acquisitions gain this experience? One approach is through participation in M&A training programs. These programs can be incredibly valuable – not only in providing some of the essential technical considerations for due diligence but also in building consistent processes. These programs can also afford insights into the “best practices” engaged in by other experienced acquirers. These programs can often be tailored to the specific needs of individual organizations whether it’s related to specific process expertise or geographic requirements.

For many organizations today, the only way to achieve their growth objectives is through acquisitions. For those organizations, due diligence becomes a core requirement – not only to identify the appropriate acquisitions and to pay the right price, but also to avoid making a bad acquisition that can have lasting consequences.

With the increasing focus on growth in acquisitions, there is an attendant focus on the talent that is essential to that growth. By improving their capabilities in human capital due diligence, organizations are improving their ability to better understand that talent and, in turn, help to drive acquisition success.

Author

David Kompare, Partner, Aon Merger &Acquisition Solutions ([email protected])

Get in touch