The Blind Spot

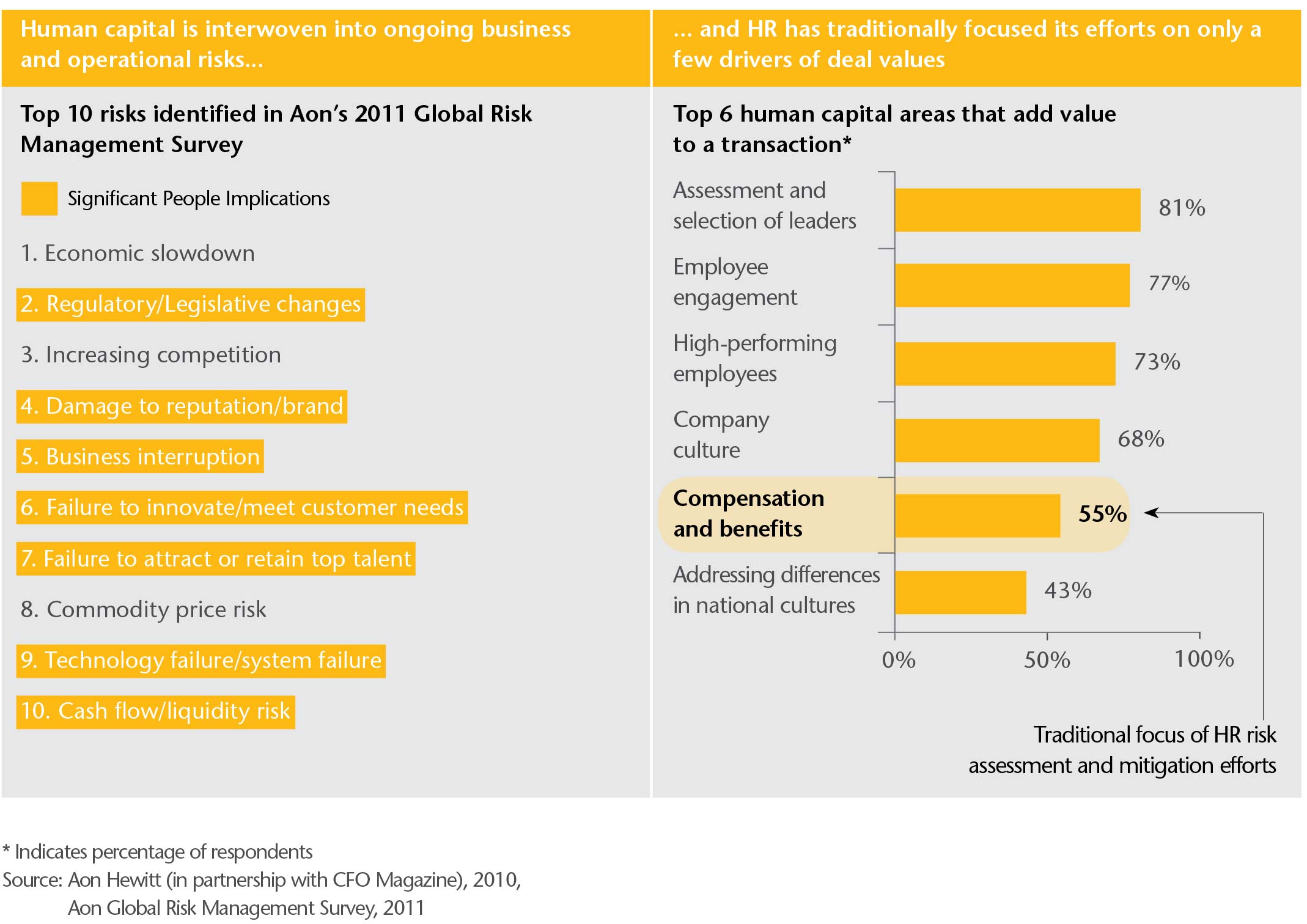

Our research with CFOs and CEOs indicates that five of the top seven operational risks identified (and seven of the top ten) have a direct and significant human capital linkage (see graphic below). Based on our body of work in advising over 3,000 transactions and USD 1.5 Trillion worth of deals, we encounter such examples fairly often. For example, business interruption is a key identified risk that is clearly and directly impacted by human capital aspects such as key talent/key skills flight, employee transfer delays/disruption, employee productivity and engagement drops, misaligned KPIs post transactions, etc.

Unfortunately, we continue to see business and HR leaders focusing only on traditional human capital risks like employment terms, employee relations, compensation & benefits, and liabilities. Make no mistake, these risks are important, but these are “table stakes” and “blocking and tackling issues.” Most times, the strategic human capital risk levers that are critical to the success of the transaction are completely missed or not adequately understood and addressed. This is a huge blind spot for most business and HR leaders alike. Only some sophisticated acquirers, in our experience, have made this connection. Interestingly, this is not about operational risk mitigation alone, but also about knowing what elements will drive or derail cost and growth synergies, as pointed out above. Smart clients appreciate that, assess and quantify the risk, and put correction mechanisms into effect during integration planning or pre-Day 1.

Deconstructing the Operational-Human Capital Risk Linkage

Not surprisingly, both in our client experience and our research, we find that successful acquirers display the common trait of understanding these risk linkages and starting to embed them in their “M&A Playbooks”.

One example of embedding risk linkages in an M&A playbook comes from a successful global industrial organization. This organization recognized that the success of their acquisitions was heavily dependent upon achieving the Year 1/Year 2 acquisition pro forma results, and aligning and retaining the key business leaders to achieve those results. Their approach, which has proven extremely successful, is to design significant performance-based retention incentives for key members of the leadership team. These performance-based incentives are tied directly to the pro forma business deal objectives that were mutually agreed to between the organization and these leaders.

Another example of embedding risk linkages comes from a leading global technology organization. This organization often makes acquisitions of smaller, entrepreneurial technology start-ups. They recognize that the key risk in their acquisitions is loss of the intellectual and human capital of the acquired organizations. All elements of their integration strategy are designed to welcome, engage, integrate, and retain key talent. This focus is clearly seen in their separate workstream devoted exclusively to executive/leadership onboarding and their highly visible, measured goal to have all targeted employees join their organization in each acquisition. Their success shows in their ability to retain more than 90% of their acquired employees three-years post-close and the fact that many acquired leaders move into other roles within the business.

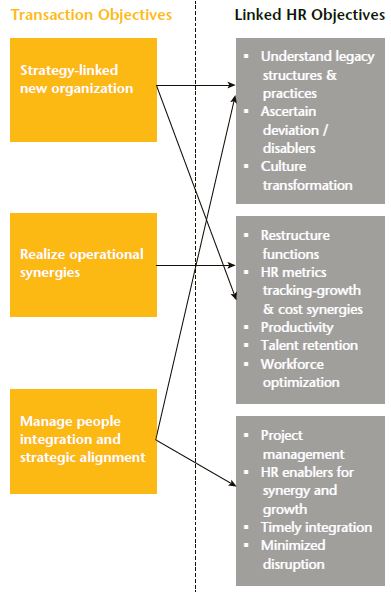

Illustration

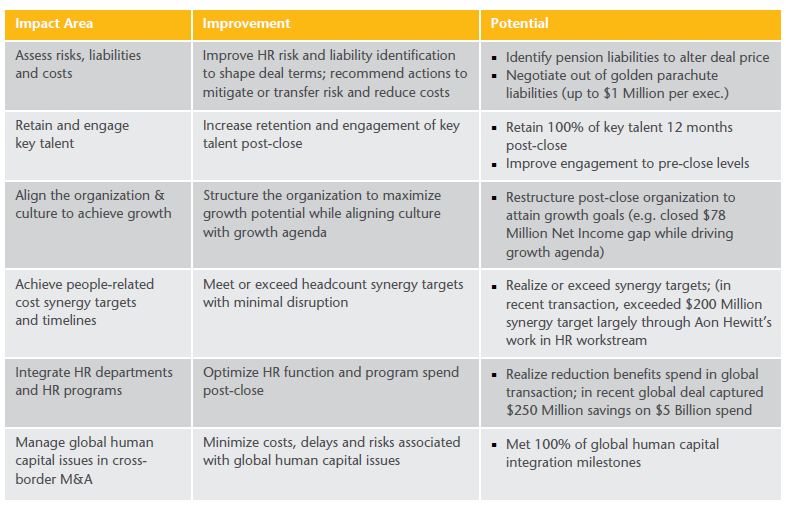

HR Value Can Be Measured Along Several Dimensions

In Asia Pacific, we tend to find this issue is exacerbated both in domestic and outbound deals. We are finding that firms in Asia do not even focus on the basic human capital risks, let alone the higher order strategic human capital levers. In domestic deals in Asia, we routinely find clients thinking that they anecdotally understand the human capital risks or that these risks can be managed or that such risks will probably not be material enough. It may be so, but there are so many instances of human capital risk being discovered post-close and then given to HR to resolve.

For example in a China deal for an industrial client, the deal was pushed through by business which involved a large manufacturing facility, without adequate focus on operational human capital risk issues. A major synergy premise of the deal was to drive cost and operational efficiency in the factory and to ramp up production. Postclose they discovered:

-

They had completely missed the fact that the salary payments to workers were being made in a non-tax compliant manner.

-

The concept of a productivity bonus was not at all linked to productivity or quality, but instead to number of hours worked.

-

The productivity bonus, when investigated further, was in reality a core part of the fixed salary, and very low compared to market prevalance.

-

The employees had to work long hours to take home adequate pay.

-

A significant cost impact to restructure salary payments and related social security costs, instead of saving costs.

-

Very low engagement due to the high work hours and attrition, which caused significant business disruption.

-

The drive for productivity, which required a whole new bonus program, cost outlay, and a huge culture/ mindset shift.

-

The realization that it may even require having to lay off and hire new employees, again causing both growth risk and cost implications.

-

Their inability to hire employees from the market to ramp up production capability, as per plan.

Needless to say, the operational efficiency cost and growth synergy goals could not be met, jeopardizing the deal premise itself.

The risks in outbound deals are even larger, with huge cost and deal success implications, yet we still find very few clients trying to understand and pull the levers that will be critical to deal success.

The Gradual Journey to Discovery

We do realize that this issue will not be resolved by one spectacular moment of “enlightenment”, but rather will be an individual journey for each firm, punctuated by learnings from being “burned” in prior deals or mistakes, and education by experts like us or within their organizations. Firms in the West also went through, or are going through, a similar journey.

Moreover, we also recognize that the stakes now are much higher than before, complexities are more, and timeframes given for success are shrinking. So, the smarter clients have accelerated this learning process.

Our research and body of experience indicate that there are some tenets that can help in accelerating this journey.

With the number of intra-Asia Pacific and outbound deals to the West increasing dramatically, the Asian clients who will stand out as successful in growing through transactions are the ones that accelerate this learning curve.

With the number of intra-Asia Pacific and outbound deals to the West increasing dramatically, the Asian clients who will stand out as successful in growing through transactions are the ones that accelerate this learning curve.

Authors :

Sharad Vishvanath, Partner, Asia Pacific Head, Aon M&A Solutions ([email protected])

David Kompare, Partner, Aon M&A Solutions ([email protected])

Get in touch