From Aspiration to Accountability: Why Quantified ESG Targets Drive Executive Performance

Environmental, Social, and Governance (ESG) is a framework used to evaluate how an organization performs in areas beyond traditional financial metrics. ESG is about measuring and managing the non-financial factors that affect a company’s sustainability, risk and long-term value creation.

Why is ESG a Strategic Priority?

In addition to ensuring regulatory compliance, ESG integration offers multiple strategic advantages. For instance, strong ESG performance demonstrates enhanced risk management capabilities, particularly regarding climate-related hazards and fines in energy-intensive industries. Through operational improvements, energy conservation, and resource management, ESG initiatives can drive cost efficiencies. Robust ESG practices attract ESG-conscious investors who increasingly consider sustainability factors when making investment decisions. Additionally, ESG enhances corporate reputation and supports competitive differentiation in markets where consumers and business partners prioritize sustainable practices. The Nomination & Remuneration Committee should integrate ESG principles to enhance accountability and ensure sustainable practices align with company objectives.

Environmental (E): Climate Action and Resource Stewardship

The Environmental aspect of ESG examines how businesses impact nature and mitigate climate change threats. Key components include greenhouse gas emissions through Scope 1, 2, and 3 emissions tracking.

- Scope 1 emissions represent direct emissions from sources owned or controlled by companies, such as manufactured fuels, heating sources, GHGs (air conditioning units), factory fumes and chemicals.

- Scope 2 emissions encompass indirect emissions from purchased electricity, steam, heat, and cooling consumed by organizations.

- Scope 3 emissions include all other indirect emissions across the value chain, often representing the largest portion of a company's carbon footprint (waste generated in operations- waste sent to landfills and wastewater treatments).

Environmental priorities increasingly center on net-zero and carbon neutral pledges. To tackle environmental challenges, companies are using renewable energy, following circular economic principles, practicing water stewardship, and working to save biodiversity. For example, a leading Indian next generation digital services firm has been at the forefront of implementing sustainability initiatives with 77.7% of its electricity consumption in India coming from renewable sources in fiscal 2025.

Social (S): Human Capital and Community Impact

Social factors examine how organizations manage relationships with employees, suppliers, customers, and communities. Key areas include diversity and inclusion, human rights, labor practices, employee health and safety, customer satisfaction, and community engagement.

Aon's Women in the Boardroom reveals critical insights about gender representation in Indian corporates. Overall women representation stands at 18.2%, with significant variations across sectors and organizational levels. Life Sciences and Consumer Goods lead with 24% and 23% female board representation, respectively, aligning closely with their overall workforce diversity (24% and 22%).

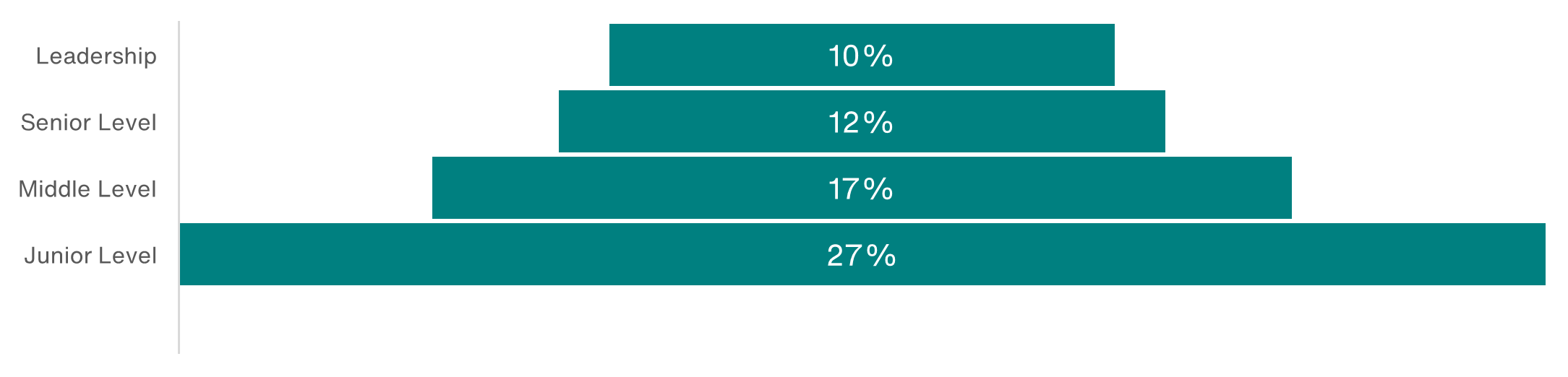

According to Aon’s SITS report (2025), women representation in top leadership remained a meagre 10% across all industries. While regulatory mandates like the Companies Act, 2013, and SEBI directives have increased the number of women on boards, these efforts have largely focused on board-level quotas rather than addressing the foundational issue of lack of women in senior management and executive roles that serve as the pipeline for board appointments.

Average Percentage of Women by Level of Management

Governance (G): Leadership and Accountability

Governance encompasses transparent corporate leadership structures, executive compensation, audits, internal controls, shareholder rights, and ethical business practices. In the financial sector, governance priorities focus on regulatory compliance, risk management, data protection, cybersecurity, and transparent decision-making processes. Good governance means the board keeps a close watch, people are held responsible, and everyone's interests are in sync. The Reserve Bank of India’s 2024 draft climate risk disclosure framework follows global trends by stressing governance, risk handling, and accountability for climate action.

ESG Regulatory Framework in India: SEBI and RBI Mandates

India’s regulatory landscape is rapidly evolving to strengthen corporate sustainability practices. According to Section 166(2) of the Companies Act 2013, directors have a fiduciary duty to act in the best interest of the company, which includes considering ESG factors in governance decisions. The Securities and Exchange Board of India (SEBI) requires the top 1,000 listed companies by market capitalization to submit a Business Responsibility and Sustainability Report (BRSR), ensuring greater transparency in ESG performance. Complementing this, the Reserve Bank of India (RBI) released a draft Climate Risk Disclosure Framework in February 2024, which will make it mandatory for regulated entities—such as scheduled commercial banks, urban cooperative banks, financial institutions, and select non-banking financial companies—to disclose climate-related financial risks and opportunities starting from FY 2025-26.

Global Trends in ESG Integration into Remuneration

The integration of ESG performance metrics into executive compensation plans is gaining momentum globally. As of 2023 as per various market research studies, 75.8% of S&P 500 companies incorporate ESG metrics, up from 66.5% in 2021. Globally, 77% of executive incentive plans now include ESG metrics, with Europe leading at 91% and the US at 75%. The European Union has enacted comprehensive ESG regulations, including the Sustainable Finance Disclosure Regulation (SFDR) and the Corporate Sustainability Reporting Directive (CSRD), promoting transparency and preventing greenwashing. CDP highlights that 94% of investors use ESG ratings monthly, underscoring their importance in financial markets. Further proxy advisors like Institutional Investor Advisory Services (IIAS), Glass Lewis and DJSI (Dow Jones Sustainability Index) provide benchmarks for ESG performance, encouraging companies to improve their sustainability practices.

How to integrate ESG into Remuneration

Integrating ESG into remuneration is becoming imperative in driving organizations’ sustainability goals. Institutional investors and proxy advisors expect stronger alignment between companies’ overall ESG goals and executive remuneration. Board NRCs need to have a higher focus to drive management responsibilities towards ESG goals which can be done by considering the following factors:

1) Aligning ESG goals with organizations’ strategy

- Identify material ESG issues – Focus on ESG factors most relevant to the industry and operation style e.g., carbon reduction, DEI, etc.

- Link the ESG goals with long-term strategy – ESG metric should reflect long-term goals of the company

2) Define clear and measurable ESG metrics

- Quantitative – e.g., CO2 reduction, safety incidents, percentage of women in leadership, etc.

- Qualitative – Better ESG disclosures, stakeholder engagement, etc.

3) Decide where to include ESG goals

- Short Term Incentives – Typically operational metrics such as workplace safety, employee engagement, diversity hiring, etc.

- Long Term Incentives – Typically Net-Zero pathway, supply chain sustainability, etc.

4) Maintain transparency

- Use third party benchmarks or ratings to ensure transparency

- Disclose ESG metrics, performance and the impact on payouts

5) Train Board to maintain strict oversight

- Ensure board members are trained to handle ESG issues

- NRC should periodically review and monitor progress and approve payouts

Prevalence of ESG Goals in BSE 30 companies

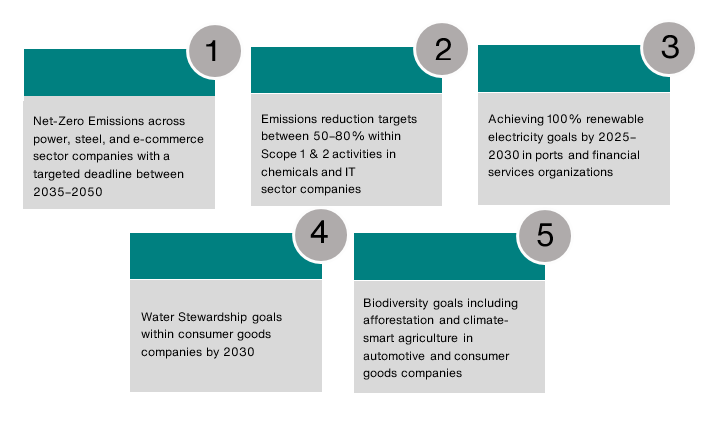

All BSE 30 companies have set an overall ESG strategy for them. Among them, several common ESG targets emerge across sectors. Carbon neutrality and net-zero commitments represent the most prevalent environmental goals, with target horizons typically spanning 2030 to 2050. For example, a prominent Indian steel manufacturing company managed to reduce its carbon emissions by 13% in 4 years between 2016-2020 through targeted initiatives like reducing plastic utilizations in its steel-making process.

Most prevalent ESG ambitions among BSE 30 companies include the following:

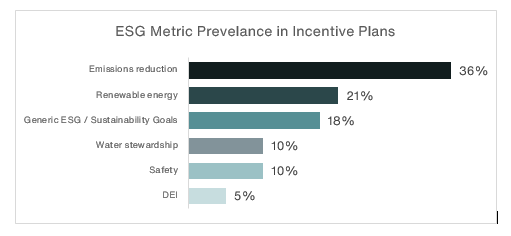

ESG Metric Prevalence

Aon's proprietary research of BSE 30 companies demonstrates clear prioritization patterns in ESG metric integration. Emissions reduction represents the most prevalent environmental target at 36%, followed by renewable energy initiatives at 21%. Generic ESG/Sustainability Goals account for 18% of implementations, while water stewardship and safety metrics each represent 10%. Diversity, Equity, and Inclusion (DEI) metrics appear in only 5% of plans despite growing stakeholder emphasis.

About 45% of Fortune Global 500 companies have pledged to achieve net-zero emissions by 2050. Industry analysis reveals sector-specific ESG focus areas. Manufacturing companies prioritize environmental metrics due to direct operational impacts, while technology and services sectors emphasize social factors including workforce diversity and digital inclusion. Financial sector institutions concentrate on governance metrics reflecting regulatory requirements and risk management imperatives.

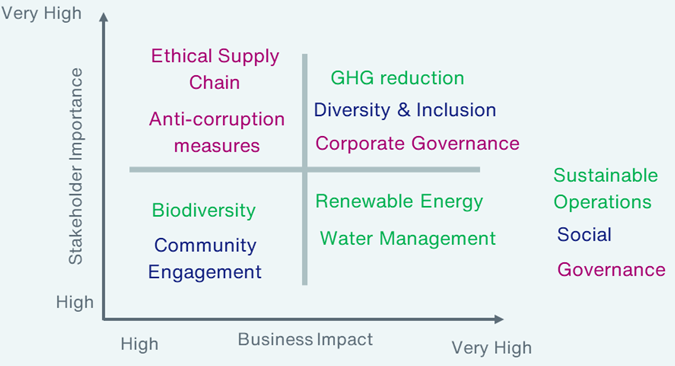

Materiality Matrix

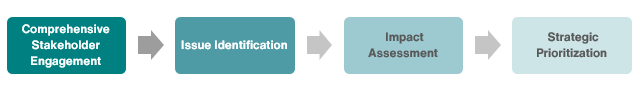

ESG materiality assessment enables organizations to identify and prioritize the most significant environmental, social, and governance issues affecting business operations and stakeholder expectations. The process involves comprehensive stakeholder engagement, issue identification, impact assessment, and strategic prioritization.

The materiality matrix utilizes two-dimensional approach mapping stakeholder importance against business impact. The framework identifies GHG reduction, Diversity & Inclusion, and Corporate Governance as highest priority issues occupying the upper-right quadrant. Renewable Energy and Water Management appear as high business impact initiatives, while Biodiversity, Community Engagement, and Ethical Supply Chain represent important stakeholder concerns requiring strategic attention.

Organizations utilize materiality assessments to align sustainability strategies with business objectives, enhance regulatory compliance, and strengthen stakeholder relationships.

Challenges & Future Outlook: ESG Evolution and Strategic Implications

- ESG is moving beyond mere compliance to become a core part of business development, adding real value. However, companies often struggle to measure their ESG goals due to inconsistent reporting standards

- ESG is moving beyond mere compliance to become a core part of business development, adding real value. However, companies often struggle to measure their ESG goals due to inconsistent reporting standards

- With regulations tightening, companies must keep up with mandatory climate risk assessments and standardized reporting. Integrating ESG into everyday operations remains a complex task

- More firms are tying ESG metrics to executive compensation, emphasizing the importance of sustainable practices. This requires effective systems to track and connect ESG performance to pay

- As per the Harvard Report, top global CEOs are focusing on climate resilience, water management, and social equity. Despite this, companies face difficulties in effectively measuring and reporting these priorities

- Firms should focus on creating thorough ESG strategies that include stakeholder engagement, performance tracking, and clear reporting. New reporting standards like BRSR help by requiring third-party verification

Contact Us

For any queries, write to us at -[email protected]